What Retirees Need to Know About ‘Per Stirpes’ and Family Inheritance

Per Stirpes is a term you’ll often see on beneficiary forms for retirement accounts, life insurance policies, and other assets. While it sounds like complicated legal jargon, understanding what per stirpes means is important as it can completely change who inherits your money and whether your beneficiary’s children are included in your plan.

Beneficiary designations often matter more than your will. That’s because accounts like IRAs, 401(k)s, and insurance policies go directly to whoever is listed on your beneficiary form. These forms override your will. So if the two don’t match, the beneficiary form wins.

This is why a detail like per stirpes matters so much.

Why Beneficiary Designations Deserve More Attention

Beneficiary listings should be a part of your regular financial reviews as these designations are a crucial part of both your retirement & estate plan.

Simply put, your beneficiary designations:

- Bypass probate. With properly named beneficiaries, assets go directly to your loved ones, without having to include the assets in probate.

- Override your will. Even the best-written will won’t change what’s on a beneficiary form.

- Give you options. Beyond naming someone, you can also decide how their share should be handled if they’re not alive to receive it.

That last option is where Per Stirpes comes in.

What Does “Per Stirpes” Mean?

The phrase per stirpes comes from Latin and means “by branch.” Here’s what it means in practice if you were to pass away:

- If your beneficiary is alive, they would simply inherit their share as normal.

- If your beneficiary has passed away, their share would pass down to their children.

It’s a way of making sure a family branch is represented, even if the person you named isn’t alive. If per stirpes isn’t elected, you may be unintentionally “disinheriting” the children of a beneficiary.

An Example

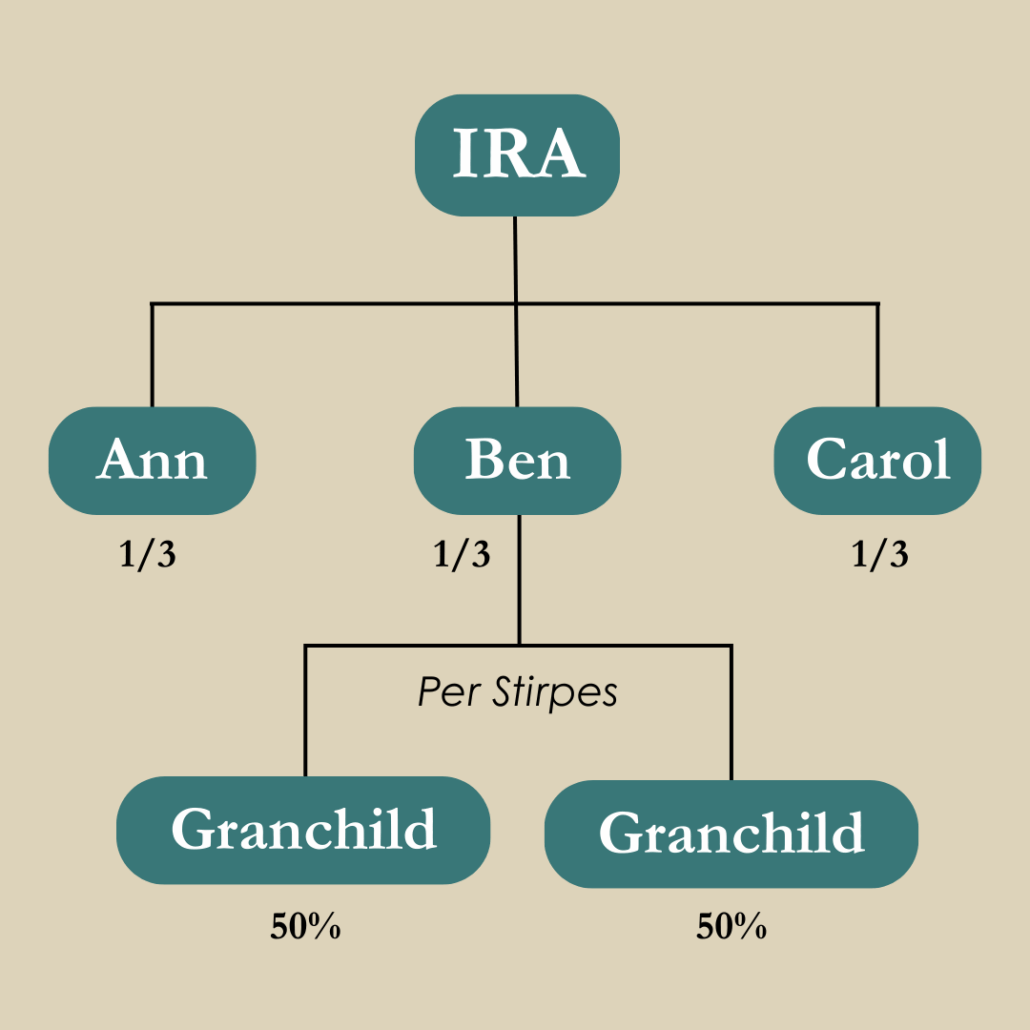

Let’s say you name your three children—Ann, Ben, and Carol—as equal beneficiaries of your IRA, and you add per stirpes after each name.

If all three are alive when you pass away, each gets one-third.

But if Ben passes away before you, his one-third doesn’t go to Ann and Carol. Instead, it goes to Ben’s children. If he had two kids, they’d each inherit half of his share (1/6 each).

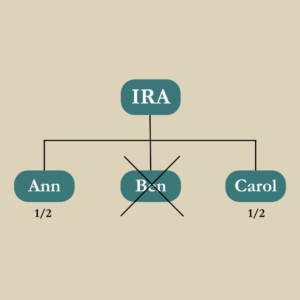

Without per stirpes, Ben’s kids would get nothing, and Ann and Carol would each inherit 50%.

A Few Things to Keep in Mind

There are a variety of reasons why someone may decide that per stirpes is a good fit in their retirement & estate plan. It ultimately depends on what you’re hoping to accomplish within your own retirement plan.

Some additional things to consider:

- Do you want them to inherit? There’s a chance that you may not want your beneficiary’s children to inherit the money.

- Ages. Would the children be able to manage the inheritance on their own? Are any of the children minors?

- Family complexity. Per stirpes may not work well in cases with complex family relationships as it only follows blood lines. So adopted children, stepchildren, etc. could be excluded.

- Taxes. Per stirpes doesn’t consider the tax situation of the children. There could be cases where the children’s tax bill is larger or they may not have much flexibility to manage tax on the inheritance.

Bottom Line

It’s not easy to think about a future without you in it, but making sure your beneficiary designations are set up correctly is one of the most important (and often overlooked) steps in building a complete retirement plan.

If you’re considering naming your children as primary beneficiaries (or already have) and your grandchildren are grown and financially independent, then checking the per stirpes box may be a pretty straightforward decision.

On the other hand, if your grandchildren are still minors, it might make sense to consider other estate planning tools to accomplish what you’re looking for.

This is why it’s so important to work closely with both a financial advisor and a qualified estate planning attorney. Together, they’ll help you coordinate your retirement plan, estate documents, and tax plan so your wishes are carried out exactly as intended.

To your next adventure.

Need Professional Retirement Planning Help?

Schedule a Free Retirement Review

Learn how to lower taxes, invest smarter, and maximize your retirement.

Disclaimer: None of the information provided herein is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Next Adventure Financial LLC does not promise or guarantee any income or particular result from your use of the information contained herein. Under no circumstances will Next Adventure Financial LLC be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate any information, opinion, or other content contained.

Welcome to the Next Adventure Financial blog, where we share insights for people 50+ who want to lower taxes, invest smarter, and retire confidently.

About the Author

Cody Lachner, CFP®, EA, is a fiduciary financial advisor & retirement planner and founder of Next Adventure Financial in Lafayette, Indiana. He specializes in helping people aged 50+ who want to lower taxes, invest smarter, and avoid costly mistakes in retirement. Cody works with clients virtually across the U.S. and is known for making complex topics like retirement planning, Social Security and tax planning easy to understand.