Health Insurance Before Medicare: How to Bridge the Gap Without Overspending

Most people plan to retire around age 65, mainly because that’s when Medicare begins. Most would love to retire sooner, whether at 60, 62, or even earlier, but the #1 thing that stops most in their tracks is what to do about health insurance before Medicare begins.

Thankfully you have options. With some planning, there are plenty of affordable ways to bridge the gap without overspending and impacting your retirement goals.

Why Health Insurance Gets Tricky Before Age 65

When you stop working before Medicare eligibility (age 65), you lose employer-sponsored coverage; for many, this is often the most affordable type of insurance they’ll have. What replaces it isn’t always simple or cheap.

The health insurance puzzle is tricky before 65 for a number of reasons:

- Employer coverage ends once you leave your job (with some short-term exceptions).

- COBRA coverage is temporary, typically lasting up to 18 months.

- Private insurance can be expensive if you don’t qualify for subsidies.

- ACA Marketplace plans can be affordable but only with the right income strategy.

The health insurance decision isn’t just about finding a plan, it’s about something that covers what you need and also fits within your retirement budget. The decisions you make during these pre-Medicare years can have ripple effects for decades.

Understanding Your Main Options for Health Insurance Before Medicare

Below, I’ll break down the most common options you’ll have if you plan to retire before 65.

1. ACA Marketplace Plans (Affordable Care Act)

For most early retirees, ACA Marketplace plans (often called “Obamacare”) are often the go-to solution. These plans are available through Healthcare.gov or your state’s marketplace, and they offer income-based premium subsidies that can make coverage very affordable.

The major takeaway is that these ACA subsidies are based on income, not assets.

So even if you have a large portfolio, you can often qualify for reduced premiums if you manage your income strategically.

For example:

A 62-year-old couple with $1.2 million in savings might only show $50,000 in adjusted gross income if they draw strategically from Roth IRAs and taxable accounts. This could qualify them for thousands in ACA premium subsidies which could substantially cut their annual premium costs.

For the past few years, there have been expanded & enhanced subsidies that were offered but it appears that these will not be extended past 2025. We discussed these changes in more detail in our article – Early Retirement Health Insurance in 2026: Planning for the ACA Subsidy Cliff.

You can explore your state’s marketplace options at any time to view plans and costs. If you choose to take an ACA plan, open enrollment runs each year between November 1 and January 15. This allows you to review and change your coverage for the upcoming year during.

You’ll likely qualify for a special enrollment period after leaving your job at retirement. This would allow you to enroll in a plan outside of the general open enrollment window.

2. COBRA Coverage from Your Former Employer

COBRA is a provision that allows you to continue on your employer-sponsored health insurance for up to 18 months after leaving your job. It’s often the most convenient short-term option and it lets you continue using the same doctors and the same benefits you’re used to. But it can be expensive since you’re now responsible for the full premium (plus up to a 2% admin fee).

When it may make sense:

- You only need short-term coverage, for a year or less, before Medicare.

- You or your spouse have ongoing treatments where continuity matters.

When it may not make sense:

- You’re healthy and can find similar ACA coverage at lower cost.

- You want predictable coverage past 18 months (COBRA ends abruptly).

For those retiring at 63½ or later, COBRA can be an effective “bridge” until Medicare eligibility but you’ll still want to compare it to other options.

3. Spouse’s Employer Coverage

If your spouse plans to continue working, you might consider joining their employer-provided health insurance plan (if available) as this is usually the simplest path, and possibly even lowest cost option.

You’ll want to compare premiums and deductibles carefully, and make sure you understand when you can be added. Most employers typically allow mid-year changes for qualifying life events like retirement.

4. Private or Short-Term Health Insurance

Private plans and short-term policies may sound appealing due to lower upfront costs, but they come with some significant limitations:

- Many don’t cover pre-existing conditions.

- Coverage can be capped or terminated after 12 months.

- Benefits are often bare-bones compared to ACA-compliant plans.

These can work as true “stopgaps” but rarely make sense for retirees with meaningful health needs or long gaps before Medicare.

5. Health Sharing Ministries or Alternatives

Some early retirees consider joining health sharing ministries. The big thing to be aware of with these is they aren’t insurance; they’re cost-sharing arrangements among members with similar beliefs & values.

While monthly contributions can be lower than traditional insurance, there’s no legal guarantee of payment. And most programs won’t satisfy ACA requirements or provide coverage for pre-existing conditions.

These can sometimes be a good option for those in excellent health but if you’re exploring this route, do so carefully and with full awareness of the risks. You’ll still want to do a full apples-to-apples comparison with the other options we’ve discussed.

Bridging the Gap: Strategies for Lower Premiums

As mentioned above, the Affordable Care Act (ACA) Marketplace is where many early retirees decide to get their insurance. And it’s an area where planning ahead pays off.

Your Modified Adjusted Gross Income (MAGI) determines how much in subsidies you receive to help cover your monthly insurance premiums. So, the goal is: keep your gross income low enough to qualify for subsidies, while still meeting your income needs.

Control Your Modified Adjusted Gross Income (MAGI)

For 2026 and beyond, a couple can typically qualify for ACA subsidies if their income stays below about 400% of the Federal Poverty Level. This is estimated to be ~$85,000 for a couple based on current 2025 numbers. Read more on how your income affects your subsidies here.

Stay below that, and your premiums could drop dramatically. Go above it, and you could lose all subsidies for the year.

Because ACA looks at income (not assets), you can have a seven-figure portfolio and still qualify, assuming you manage withdrawals carefully.

Use Tax Buckets Strategically

If you have a mix of pre-tax, Roth, and taxable accounts then you’ll have quite a bit of flexibility in controlling your income. That’s because you can strategically draw from certain accounts to get your income in the “sweet spot.”

Here’s how having a mix of accounts helps:

- Roth withdrawals don’t count toward MAGI.

- Taxable accounts can provide you with income through long-term gains that are often taxed at 0–15%. Plus, if you have losses, those losses can offset gains.

- IRA withdrawals raise MAGI directly, so you can time them around subsidy thresholds.

Be aware though: you likely won’t want to make your income $0. You’ll typically need to have enough income that at least exceeds your state’s Medicaid threshold.

Coordinate Roth Conversions Carefully

Roth conversions involve moving money from your pre-tax accounts into Roth. They can be a powerful long-term tool helping build larger tax-free balances but in your pre-Medicare years, they’ll also increase income and potentially reduce ACA subsidies.

That doesn’t mean you should avoid them. It just means you’ll want to thoughtfully consider them with the rest of your retirement & tax goals. But, in many cases, it generally makes sense to wait until age 65 to avoid impacting your ACA subsidies.

All that said, it’s still worth exploring how conversions would impact ACA premiums today and how they may lower your future RMDs and Medicare surcharges (IRMAA) later in retirement.

Avoiding Common Mistakes When Covering Health Insurance Before Medicare

Many early retirees make simple but costly errors when bridging this gap. Here are four to avoid:

Mistake #1 – Over-withdrawing and Losing ACA Subsidies

A single large IRA withdrawal or Roth conversion can bump your income high enough to lose thousands in subsidies. This is where annual tax planning pays for itself.

Mistake #2 – Assuming COBRA Will Last Until 65

COBRA coverage usually lasts 18 months, sometimes 36 months for dependents. If you retire at 62, you’ll have a coverage gap before Medicare unless you transition to an ACA plan.

Mistake #3 – Ignoring HSA Opportunities Before Enrolling in Medicare

Once you enroll in any part of Medicare, you can’t contribute to an HSA. If you have an HSA-eligible plan before age 65, you may want to consider whether it makes sense to max out contributions while you can.

HSA money (contributions & growth) remains tax-free when used for future healthcare expenses.

Mistake #4 – Missing Special Enrollment Windows

Leaving employer coverage triggers a 60-day special enrollment period for ACA. Miss that, and you may be stuck uninsured until open enrollment. Or if you plan to enroll in your spouse’s health insurance plan (if they’re still working), you’ll need to keep their special enrollment period in mind as well.

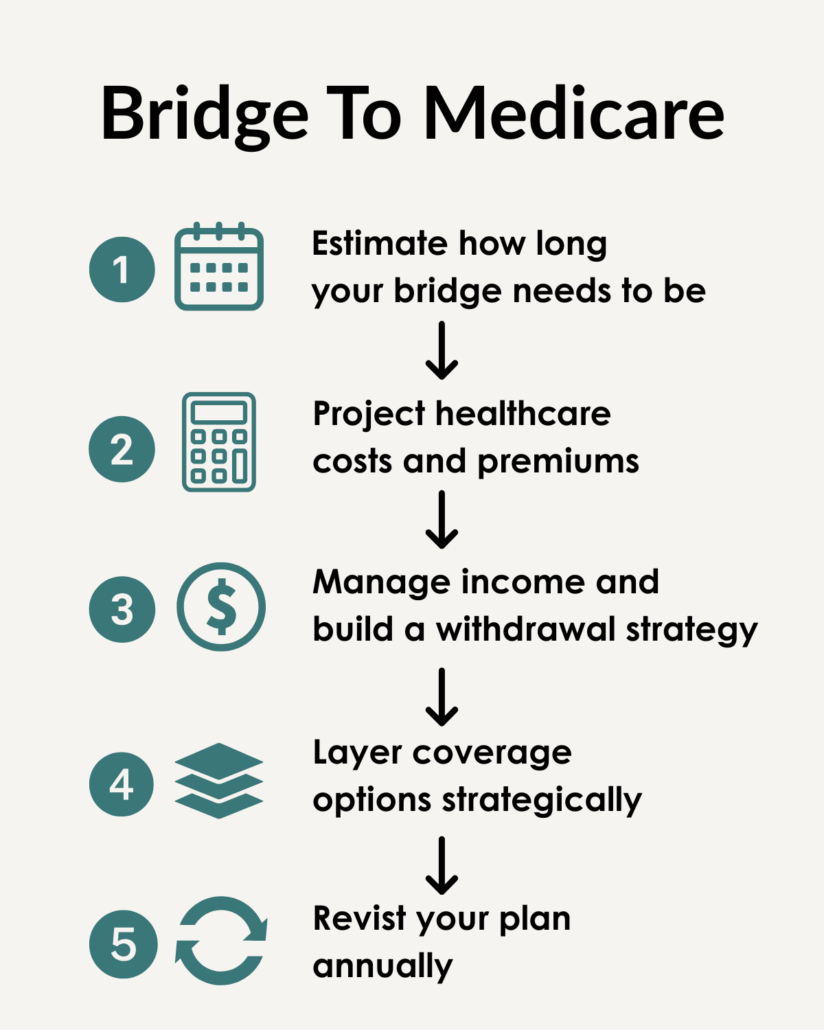

How to Build a Bridge to Medicare That Fits Your Retirement

Bridging to Medicare requires an income and withdrawal strategy to help you keep coverage affordable and aligned with your overall retirement plan.

Here’s a step-by-step way to do it.

Step 1: Estimate How Long Your Bridge Needs to Be

Start by figuring out how long you’ll need to fund health insurance before Medicare starts at age 65.

- Retiring at 63 = about 24 months of gap coverage.

- Retiring at 60 = about 60 months.

Knowing this timeline helps you map out coverage options, withdrawal needs, and how to pace income across those years.

Step 2: Project Healthcare Costs and Premiums

Next, estimate your total out-of-pocket healthcare costs during the gap years. This should include:

- Monthly premiums (with and without ACA subsidies)

- Deductibles and out-of-pocket maximums

- Prescription expenses

- Expected inflation

You can start by previewing plans at Healthcare.gov or your state marketplace to get an idea of premiums based on your projected income.

This projection will help determine how much income you’ll need to withdraw from investments each year.

Step 3: Manage Income and Build a Tax-Efficient Withdrawal Strategy

This is where most of the planning happens. Your Modified Adjusted Gross Income (MAGI) determines your ACA subsidy eligibility, and your withdrawal strategy determines your MAGI.

A smart bridge plan uses withdrawals from the right accounts at the right time to control income while still meeting your cash flow needs.

Here’s how that might look:

- Use cash and savings first.

Cash and withdrawals from your bank accounts are not counted as taxable income. These funds can allow you to meet your spending needs in a tax-smart way. - Access taxable accounts.

Withdraw principal and long-term capital gains strategically. Principal withdrawals aren’t taxable, and long-term gains may qualify for 0–20%+ tax rates depending on your income. - Tap Roth accounts for flexibility.

Roth IRA withdrawals don’t count as taxable income, so they can fill spending gaps without jeopardizing subsidies. This bucket can also be used for any unexpected expenses that pop up during the ACA years. - Limit withdrawals from pre-tax IRAs and 401(k)s.

These raise your gross income dollar-for-dollar. If you need to tap them, consider smaller, planned distributions spread over multiple years. You’ll want to evaluate how withdrawals from these accounts would affect your subsidies. - Coordinate with your investment allocation.

Having 2–3 years of expected withdrawals in cash or short-term liquid bonds can help prevent selling equities during market downturns.

Note: the “right” mix will ultimately depend on the specifics of your situation which is why it’s crucial to work with an expert.

With the right withdrawal strategy, you may be able to keep ACA premiums low and preserve portfolio longevity, which is extremely important in early retirement.

Step 4: Layer Coverage Options Strategically

You don’t have to commit to one type of coverage for your entire bridge period. Many retirees use a layered approach that evolves as they age, which could look something like:

- COBRA first:

Maintain familiar coverage for 12–18 months after leaving your employer. - ACA Marketplace next:

Transition once COBRA ends or becomes too costly. - Short-term or gap coverage:

Could be used sparingly for brief transitions (e.g., a one-month overlap).

Of course, it may even make sense to start on an ACA plan immediately in retirement; as mentioned above, the right strategy depends on your specific situation so be sure to evaluate everything before choosing a specific plan/strategy.

Step 5: Revisit Your Plan Annually

Your bridge plan likely won’t be static. It’s going to evolve each year as income, market conditions, and subsidy rules change.

Each year during ACA open enrollment (November 1 – January 15), you’ll want to review:

- Projected income for the coming year

- Withdrawal strategy (Are you drawing from the right accounts?)

- Investment mix to ensure your “safe assets” still cover near-term spending

- Upcoming Medicare and IRMAA considerations as you approach 65

Having a regular ongoing review can help keep your coverage affordable, your taxes low, and your investment strategy aligned with your retirement goals.

The Bottom Line: Health Insurance Doesn’t Have to Delay Your Retirement

Retiring before Medicare is completely doable and it doesn’t mean giving up affordable healthcare.

It just requires some thoughtful planning.

This will involve managing your income sources strategically, comparing all your coverage options, and coordinating all of it with your retirement plan.

If you do these things, you can retire when you want without letting health insurance dictate the timeline.

Next Steps:

- Consider working with an expert to map out early retirement.

- Review your health insurance options and evaluate the pros/cons of each option.

- Decide if/when you want to start Social Security.

To your next adventure!

Need Professional Retirement Planning Help?

Schedule a Free Retirement Review

Learn how to lower taxes, invest smarter, and maximize your retirement.

Disclaimer: None of the information provided herein is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Next Adventure Financial LLC does not promise or guarantee any income or particular result from your use of the information contained herein. Under no circumstances will Next Adventure Financial LLC be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate any information, opinion, or other content contained.

Welcome to the Next Adventure Financial blog, where we share insights for people 50+ who want to lower taxes, invest smarter, and retire confidently.

About the Author

Cody Lachner, CFP®, EA, is a fiduciary financial advisor & retirement planner and founder of Next Adventure Financial in Lafayette, Indiana. He specializes in helping people aged 50+ who want to lower taxes, invest smarter, and avoid costly mistakes in retirement. Cody works with clients virtually across the U.S. and is known for making complex topics like retirement planning, Social Security and tax planning easy to understand.