Early Retirement Health Insurance in 2026: Planning for the ACA Subsidy Cliff

The “One Big Beautiful Bill Act” passed on July 4th, 2025 introduced sweeping changes to our tax code, however, it did not extend the enhanced health insurance subsidies available through the Marketplace. This means early retirement health insurance could be getting more complicated beginning in 2026.

The expiration of the enhanced Affordable Care Act subsidies have the potential to make early retirement health insurance very expensive for some, especially those without a solid plan in place.

What the Health Insurance Marketplace Is (and Why Retirees Use It Before 65)

Before I dig into this, I wanted to make sure everyone is on the same page about the Marketplace.

The Affordable Care Act established health insurance “marketplaces” in each state, creating a place where individuals without employer-sponsored coverage (or those who retire before becoming eligible for Medicare) can shop for and enroll in health plans.

The nice part was that subsidies were offered to individuals and families with incomes below a certain threshold, helping to lower monthly premiums and make coverage more affordable.

Which, most retirees see a drop in income when they retire so this is perfect.

Household assets have no bearing on the amount of subsidies a family can receive.

But, prior to 2021, there was a set income cap. Exceeding that income cap (even by $1), meant losing all available subsidies for the entire year.

What Changed During 2021–2025: Enhanced Subsidies and No Income Cap

During the COVID years, various stimulus bills were passed which expanded the amount of subsidies that were offered. They also removed the income cap.

With no income cap, these subsidies would gradually decrease as a household’s income increased, until they eventually went to $0.

So there wasn’t necessarily a big “penalty” for your income being too high.

The provisions from these bills kept getting extended; the most recent extension going until the end of 2025.

2026 May Be Different: The Likely Return of the 400% FPL Cap and Smaller Subsidies

Unfortunately, the “One Big Beautiful Bill Act” did not further extend those enhanced subsidies so that means the old income cap will be returning in 2026 and subsidies may be getting smaller.

How ACA MAGI Works (In Plain English)

Your ACA “income” isn’t your gross income or your Social Security check; it’s your Modified Adjusted Gross Income (MAGI), which includes most taxable income sources like:

- Wages

- 1099 income

- IRA withdrawals

- Tax-exempt interest

- Interest, dividends and gains

- Taxable portion of Social Security income

The Income Cap

The income cap is equal to 4x the Federal Poverty Level (FPL) which is determined by how many individuals are in your household.

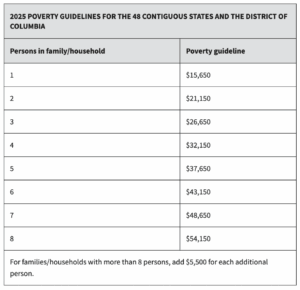

Here are the current 2025 Federal Poverty Levels:

Source: Department of Health and Human Services (https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines)

Example: What 400% of FPL Looks Like for a Retired Couple

So for a retired husband and wife, 4x their Federal Poverty Line would be $84,600 in income ($21,150 x 4).

Remember, even earning $1 over this cap means you’re ineligible for subsidies and you bear the full cost of health insurance.

Building a Tax-Smart Income Plan Before Medicare

Thoughtful retirement income planning will be a MUST for anyone planning to retire before Medicare age. It’s crucial to try to keep your gross income as low as possible until you can start your Medicare.

You’ll need to be very thoughtful about where you will draw your income from.

Here are some things to consider as you think about your retirement income plan.

Consider Which Accounts to Draw From First (Cash, Taxable, Tax-Deferred, Roth)

Think about how you manage your household cash/savings to help minimize taxable income.

Remember, withdrawals from IRAs/401ks/403bs are fully counted as taxable income. Distributions from Roth IRAs are generally tax-free*.

On top of these things, it could be wise for some to consider delaying Social Security. With the income cap returning, it may not make sense to “turn on” that income before you start Medicare as delaying can help you retain more control over your gross income.

Make Your Taxable Account More ACA-Friendly

If you have a taxable brokerage account, you’re required to pay tax on dividends, interest, and capital gains as they’re earned; so before you retire, try to get this type of account as tax-efficient as possible.

- Minimize dividends

- Minimize interest

- Minimize or avoid capital gains, or offset any gains with losses (to the extent possible)

Certain mutual funds can send out surprise capital gain distributions towards the end of the year. So, depending on the amount you have invested in there, this is something that could easily derail your yearly healthcare plan.

Time “Big Income” Events Carefully (Roth Conversions, Rentals, Lump Sums, Side Income)

If you’re considering selling a rental property, taking a lump sum pension, doing a Roth conversion, working part-time, etc., the year you do these things could affect your subsidy eligibility.

Spreading income over multiple years or doing these things before retirement (if possible) could possibly help smooth out the impact.

Bottom Line: Precision With Income Can Help Preserve Subsidies

With the potential return of the income cap (aka “subsidy cliff”) and smaller subsidies in 2026, they’ll likely be less wiggle room when it comes to managing healthcare costs.

Thoughtful income planning and forward-looking tax planning will be critical for those planning to retire before Medicare age 65.

Next Steps:

To your next adventure.

Need Professional Retirement Planning Help?

Schedule a Free Retirement Review

Learn how to lower taxes, invest smarter, and maximize your retirement.

Disclaimer: None of the information provided herein is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Next Adventure Financial LLC does not promise or guarantee any income or particular result from your use of the information contained herein. Under no circumstances will Next Adventure Financial LLC be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate any information, opinion, or other content contained.

Welcome to the Next Adventure Financial blog, where we share insights for people 50+ who want to lower taxes, invest smarter, and retire confidently.

About the Author

Cody Lachner, CFP®, EA, is a fiduciary financial advisor & retirement planner and founder of Next Adventure Financial in Lafayette, Indiana. He specializes in helping people aged 50+ who want to lower taxes, invest smarter, and avoid costly mistakes in retirement. Cody works with clients virtually across the U.S. and is known for making complex topics like retirement planning, Social Security and tax planning easy to understand.