Are Social Security Benefits Taxable?

Nearly every taxpayer pays into Social Security during their working years. As folks approach their Social Security claiming age, I commonly get asked the following question – “Are Social Security benefits taxed?”

The short answer is – it depends.

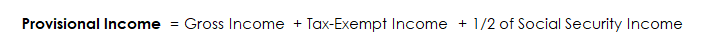

The first step in figuring out whether you pay any tax on your Social Security benefits is to calculate something called your Provisional Income (let’s shorten this to PI).

PI is an arbitrary number the IRS uses to determine whether you pay any tax on your benefits (and how much of your benefits are taxed). PI is only used for this purpose.

Here is how PI is calculated:

We’ll use this PI to get a better understanding of how much of your Social Security benefits may be taxable.

How much of my benefits are taxed?

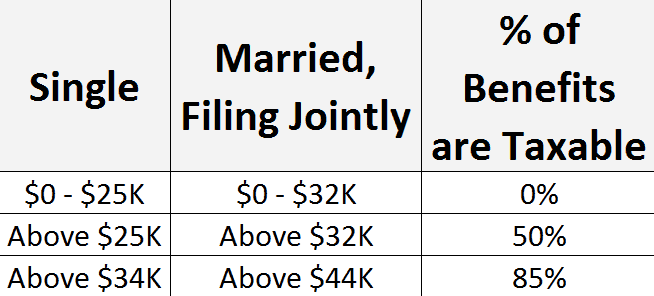

The next step is to take your PI and see where it falls on the grid above. This tells you the highest amount of your benefits that may be taxable.

So if a married couple found that their Provisional Income is $40,000 then up to 50% of their benefits are subject to tax. If their PI was less than $32,000 then all of their Social Security income would be tax free.

Note: the full calculation is less straightforward than the above example. There are more calculations that would need to be done to truly calculate exactly how much is taxable.

Here’s another quick example to show the basics in action:

Let’s assume a married couple has the following income:

- Spouse 1 has a pension of $25,000 per year and Social Security of $22,000

- Spouse 2 has no pension but collects $20,000 per year in Social Security

- Spouse 2 also draws $15,000 per year from their IRA

Their provisional income would be calculated as follows:

$25,000 + $15,000 + $10,000 (1/2 of $20,000) + $11,000 (1/2 of $22,000) = $61,000

This couple’s PI is above the $44,000 threshold so up to 85% of their Social Security income would be taxable.

You’ll notice that the maximum amount of Social Security income that can ever be taxed is 85%. Said another way, at least 15% of everyone’s Social Security benefits will be tax-free, regardless of your actual income. Sometimes even more can be tax-free, it just depends on that Provisional Income number.

Planning Considerations

Understanding how Social Security benefits are taxed is key to a tax-efficient retirement plan.

These tax considerations will play into the decision on when to start collecting your benefits and which accounts you should spend from first in retirement.

Collecting Social Security before your Full Retirement Age means that you’re locking in a reduced benefit for life; factoring in the tax implications can help give you a clearer picture of what you’ll actually receive (which may be much less than you were expecting).

Also, understanding these concepts can help you better plan for the tax liability of withdrawing money from pre-tax retirement accounts (IRAs, 403bs, 401ks, etc.). Money withdrawn from these accounts is taxable income. You may notice a big change in your overall tax liability because of how that income affects your Social Security taxation.

There’s a range of income that causes the Social Security Tax Torpedo to kick in. This is a range where the next portion of income (either earned income or money taken from retirement accounts) could result in a tax rate that’s higher than a person’s actual marginal tax bracket; the most extreme case can cause someone’s tax rate to spike to 40.7%!

This happens within the 22% tax bracket. In essence what’s happening is that each $1 of additional income in this range is being taxed at the regular 22% tax bracket but it’s also causing a person’s provisional income to increase, thereby causing an extra $0.85 of their Social Security income to be taxed as well (remember the range of PI that causes 85% of someone’s Social Security benefits to be taxed).

So, their 22% tax bracket is being increased by 1.85 (which is 40.7%).

Said another way, an extra $1 of income is being taxed at 22% and that same $1 of income is causing PI to increase; this causes $0.85 of Social Security to be taxed at the same time. So, you’re throwing $1 of new income in and, at the same time, you’re throwing an extra $0.85 of Social Security into the tax bucket that wasn’t taxed before.

Closing Thoughts

This post highlights some of the things that play into the tax calculation on your Social Security benefits. As with many things in retirement, certain decisions can have consequences elsewhere in your financial plan.

Deciding when to start claiming Social Security, choosing which account(s) to spend from first in retirement, etc. all play into how much of your benefits are taxable. It’s important to consider these things, especially the Social Security tax torpedo, as you’re making decisions.

Having a good mix of account types (Roth, pre-tax, taxable) can help you avoid this tax torpedo range. Taxable accounts and Roth IRAs can help you somewhat control how much of the withdrawal is counted as income.

Feel free to reach out if you have any questions – you can contact me through here anytime.

Also, be sure to subscribe to the Next Adventure Financial monthly retirement newsletter!

The tax and estate planning information offered by the advisor is general in nature. It is provided for informational purposes only and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

Welcome to the Next Adventure Financial blog where I share relevant info and educational content designed to help you have a comfortable retirement.

About the Author

Cody Lachner, CFP®, EA is a fee-only financial planner based in Lafayette, IN serving clients locally and virtually nationwide. Cody works with families approaching retirement and takes a tax-focused approach to retirement planning. His goal is to help families retire with confidence while lowering their lifetime tax bill.

We send out our Retirement Essentials newsletter every Wednesday which is full of information on retirement, taxes, and investing. This newsletter has plenty of content that doesn’t always make it into the blog.

Sign up below if you’d like to receive a copy!