The Widow’s Penalty: Why a Retiree’s Taxes May Go Up When One Spouse Passes Away

Most couples picture retirement as something they’ll enjoy together and the retirement plan is usually built around the idea that both spouses go through retirement together. But how would things look financially if one spouse should pass away first? In this case, there’s a tax surprise many don’t see coming: the widow’s penalty. This happens when one spouse passes away and the surviving spouse ends up paying higher taxes on less income.

What is the Widow’s Penalty?

Here’s how the widow’s penalty commonly shows up:

- Social Security Income Drops. Assuming you’re both collecting Social Security, one of the two checks goes away, leaving the survivor with the larger of the two benefits.

- Other Retirement Income Usually Continues. Your other retirement will usually continue. This could include IRA withdrawals, pensions (assuming it has a survivor feature), and investment income.

- Filing Status Changes. The survivor will begin to file taxes as single in the year following, and single brackets fill up much faster than married brackets.

It doesn’t sound fair, but it’s the reality of how our tax code works once you go from filing jointly to filing as a single person.

Why The Widow’s Penalty Matters for Retirees

The widow’s penalty is a hidden risk to a joint retirement plan. In my experience, most retirement plans don’t consider what happens when one spouse passes away. Retirement planning, in general, is all about reviewing and addressing risks; this is one that’s often disregarded.

In addition to what I’ve mentioned above, there’s a few other issues that come into play with the widow’s penalty:

- It can reduce the survivor’s lifestyle. More tax = less net income to spend.

- It can create surprise Medicare costs. High levels of taxable income may trigger Medicare surcharges.

- It can shrink retirement flexibility. With tighter after-tax income, the survivor may feel less freedom to help family, give to charities, or enjoy “extras” that were comfortable before.

These tax changes often hit during a time that one spouse is already navigating major adjustments, both emotionally and financially.

But, these tax changes aren’t something to fear, they’re something to plan & prepare for. As you’re reviewing and monitoring your retirement plan, you can review how this would impact the other spouse, think about how income sources will shift, and consider whether adjustments should be made now.

Example of How the Widow’s Penalty Works

Let’s look at an example to illustrate how this may look. Here are the details:

Bob and Sue are both age 75 and will begin taking their RMDs this year. They have the following income and assets:

- Pre-Tax IRAs = $2,000,000

- Social Security Income:

- Bob = $30,000 per year

- Sue = $25,000 per year

Based on their $2,000,000 IRA balances, their joint RMDs are expected to be ~$80,000 this year.

Now, let’s assume Bob passes away this year before taking his RMD. Sue would be required to pull the full ~$80,000 RMD, however, she would be able to file a joint return this year so, from a tax perspective, everything is as expected.

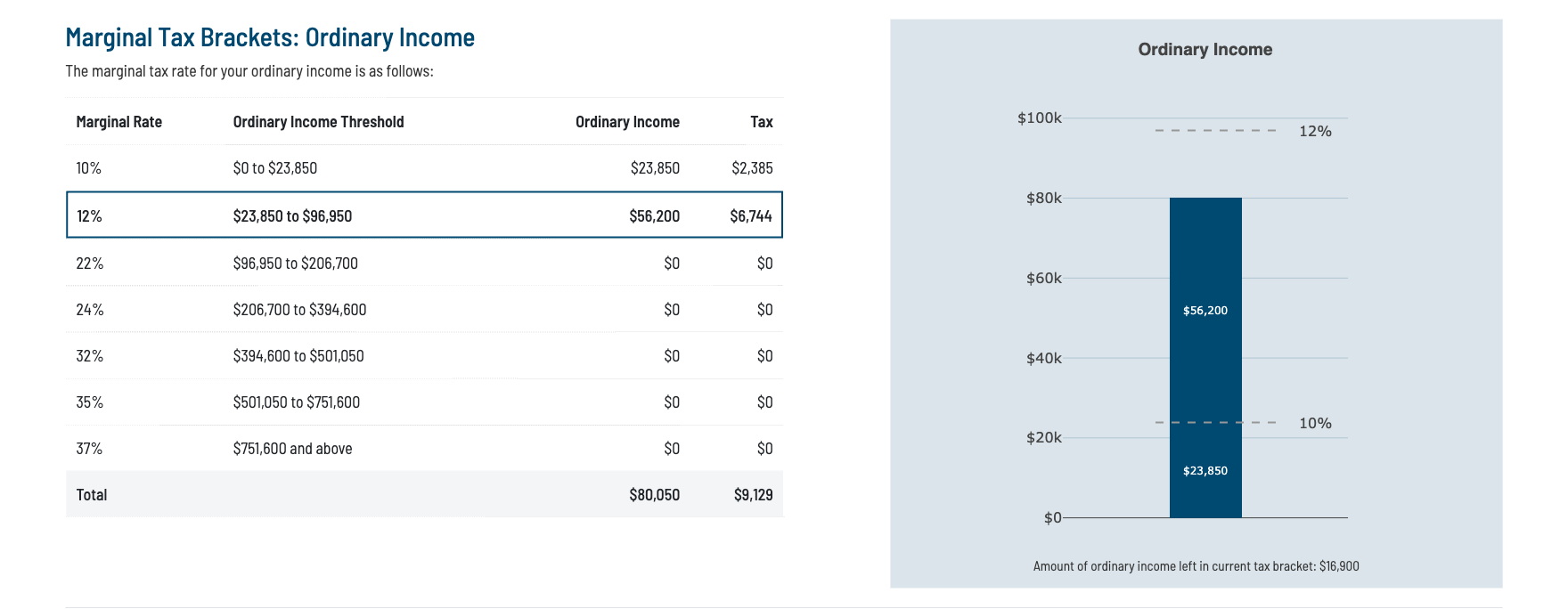

Here’s an example of how their income may look in 2025 within the Married, Filing Joint tax brackets:

Bob & Sue — 2025 Married, Filing Joint

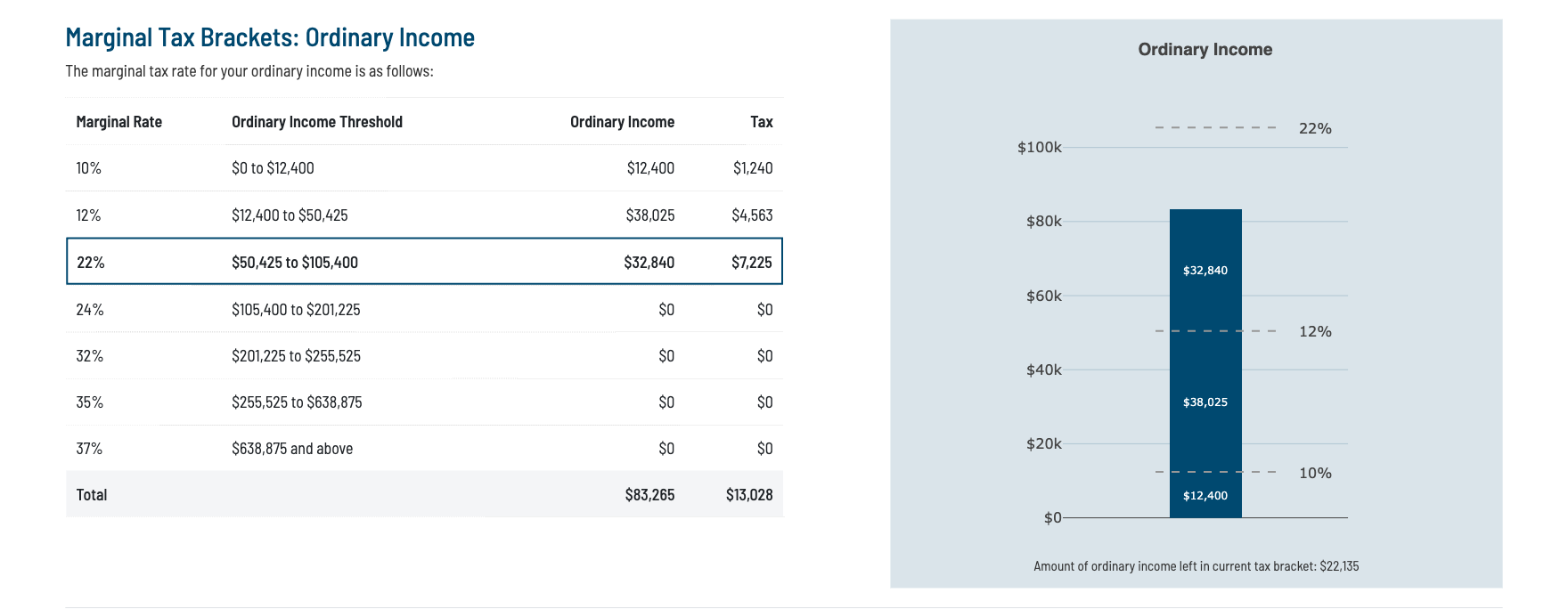

Next year (2026), this is how things may look for Sue when she begins filing as a Single taxpayer. A couple notes: she would collect Bob’s higher Social Security income (~$30,000 per year) and, assuming she was the beneficiary on Bob’s IRA, would own all IRAs and be obligated to continue her RMDs going forward. Each year RMDs get bigger, though I’ve assumed the amount would stay the same for sake of simplicity.

Sue — 2026 Single

Once filing as Single, Sue’s taxable income went up ever so slightly due to lower Single deductions, along with slightly lower income (due to less Social Security income).

👉 The filing status change from Joint to Single caused her to go from the 12% bracket with Bob to the 22% bracket and a nearly $4,000 increase in her federal tax bill.

Note: these examples are just for illustrative purposes.

How to Plan for the Widow’s Penalty

As you review your retirement plan and project how the widow’s penalty may affect you or your spouse, you can start to consider whether it makes sense to implement certain strategies today. For example: would it make sense to shift more money into tax-free accounts like Roth IRAs? Should you adjust your withdrawal strategy now? Could a charitable giving strategy help both your taxes and your legacy goals?

Here are a few planning approaches to consider:

1. Strategic Roth Conversions

Converting portions of pre-tax retirement accounts to Roth IRAs while both spouses are alive can reduce future Required Minimum Distributions (RMDs). This helps lower taxable income later, giving the surviving spouse more breathing room in narrower single tax brackets.

You can click here to read read our article about RMDs.

2. Withdrawal Strategy Adjustments

Rather than defaulting to “IRA first” or “taxable first,” review how you draw income across accounts. Depending on your circumstances, spending from the right mix of taxable, tax-deferred, and tax-free accounts can help find the best balance of taxes today while considering potential taxes for the survivor.

3. Charitable Giving Tools

If giving is already part of your life, certain strategies can reduce taxable income while supporting the causes you care about:

- Qualified Charitable Distributions (QCDs): These are direct gifts made from an IRA after age 70½ that satisfy your RMDs but aren’t taxable (up to a certain annual limit).

- Donor-Advised Funds (DAFs): This specific type of fund allows you to frontload multiple years of donations into one tax year to maximize your potential deductions, while giving you full control & discretion over when you send the funds out to certain charities.

Using these at specific times during your retirement can help to manage the tax hit from the widow’s penalty while also carrying out your shared charitable values. If you’re charitably inclined, these charitable giving tools could be put to use if/when you’re impacted by the widow’s penalty to offset the potential increase in your tax bill.

Bottom Line

The widow’s penalty isn’t talked about too much but it’s one of the most common tax “surprises” that retirees may encounter. It’s not something to fear; it’s simply something to consider as you manage your retirement plan over time.

Of course, none of us know how long we’re going to live. But we want to consider how things like this may affect each other to make sure the other spouse is taken care of should something like this happen.

To your next adventure.

Need Professional Retirement Planning Help?

Schedule a Free Retirement Review

Learn how to lower taxes, invest smarter, and maximize your retirement.

Disclaimer: None of the information provided herein is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Next Adventure Financial LLC does not promise or guarantee any income or particular result from your use of the information contained herein. Under no circumstances will Next Adventure Financial LLC be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate any information, opinion, or other content contained.

Welcome to the Next Adventure Financial blog, where we share insights for people 50+ who want to lower taxes, invest smarter, and retire confidently.

About the Author

Cody Lachner, CFP®, EA, is a fiduciary financial advisor & retirement planner and founder of Next Adventure Financial in Lafayette, Indiana. He specializes in helping people aged 50+ who want to lower taxes, invest smarter, and avoid costly mistakes in retirement. Cody works with clients virtually across the U.S. and is known for making complex topics like retirement planning, Social Security and tax planning easy to understand.